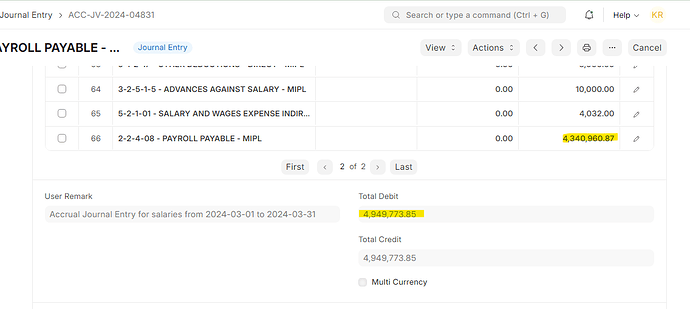

I want to understand the logic or reason why the net amounts of the Payroll JV and the Sales Register do not match when compared."

anyone know about it

Hi,

Can you share more details? For example, which column of Salary Register you are comparing with the Salary JVs etc. This will help community members to understand the exact problem and provide the proper answer.

Thanks,

Divyesh Mangroliya

If anyone have a reason ,please share

I have shared , Please Check

I’d like to clarify a potential discrepancy between the total debit amount and the total payable amount.

The total debit typically includes two components:

- Total Payable to Employees: This represents the gross salary amount owed to all employees.

- Total Taxes Payable to Government: This encompasses various taxes withheld from employee salaries, such as income tax.

Example:

Let’s consider an employee earning a gross salary of $100 with $15 income tax withheld. The journal entry would be:

- Debit: Salary Expense ($100)

- Credit: Payroll Payable ($85) (Represents net salary payable to employee)

- Credit: Income Tax Payable ($15) (Represents tax withheld)

In this scenario, the total debit ($100) reflects the full gross salary expense. However, the total payable amount ($85) only includes the net salary owed to the employee, excluding taxes withheld.

This is why the total debit might not directly match the total payable amount.

Thanks , any further explanation is there for Salary register?