As per rules of GST for POS ( If my company is based in Gujarat but I avail hotel service in Delhi so for us CGST and SGST is not applicable) How to do an entry in our erpnext so that we can claim ITC For This POS in GSTR 3B

ITC is usually ineligible in your scenario (Place of supply rules). You may however be able to claim ITC if you have registration in Delhi.

1 Like

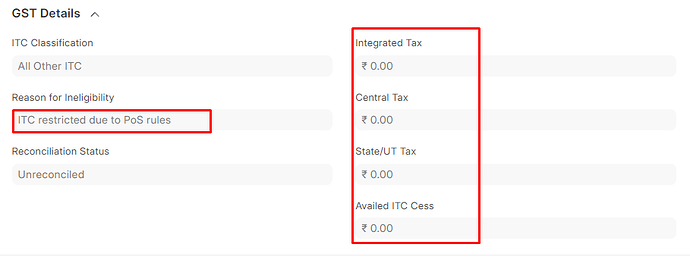

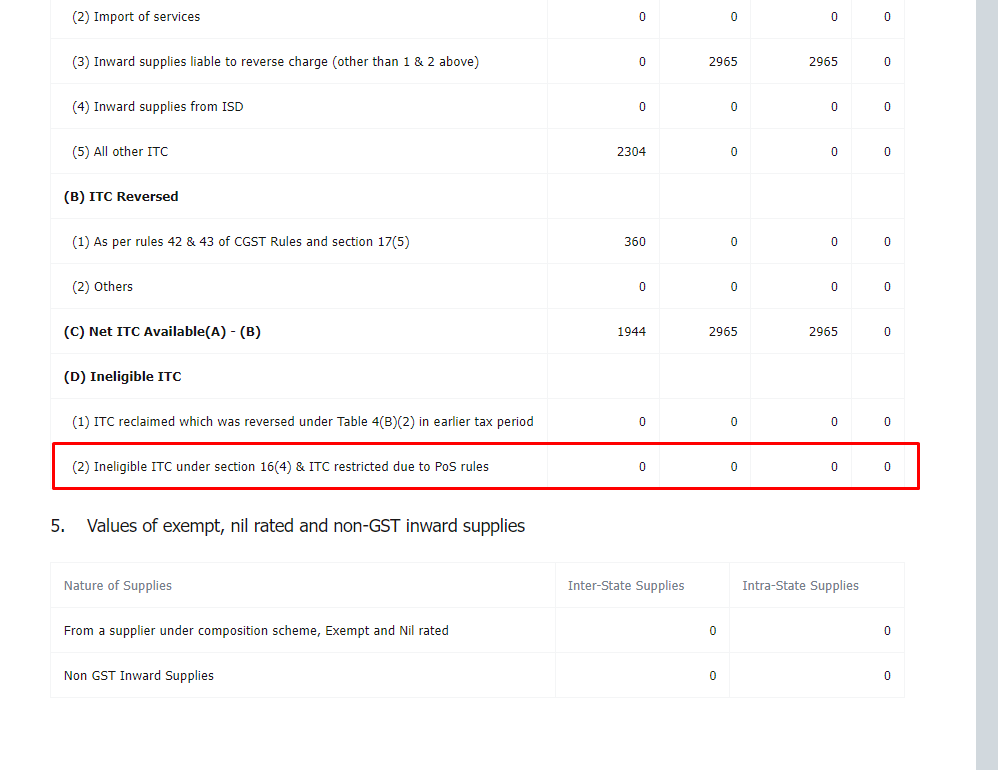

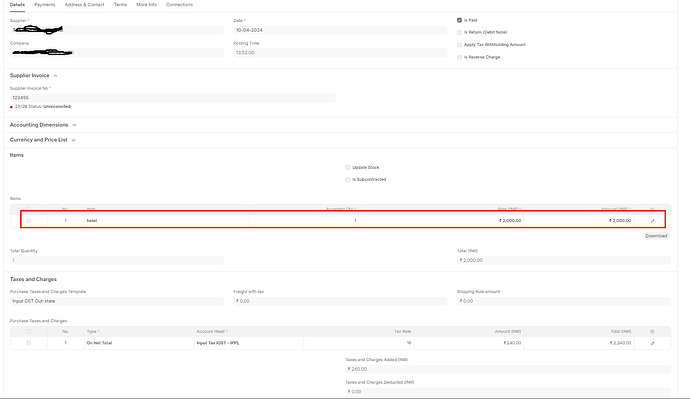

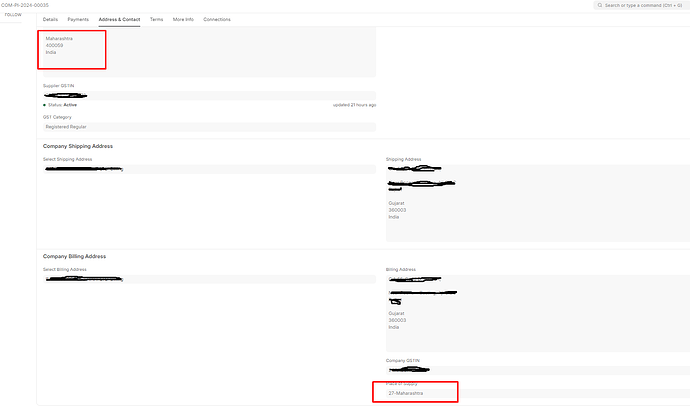

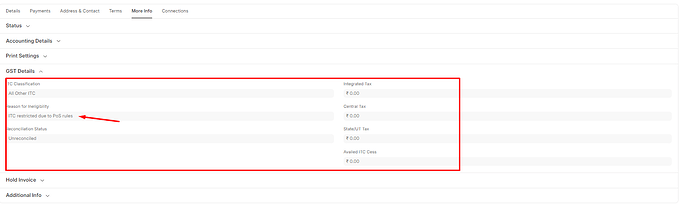

We have entered the purchase invoice for POS rules as described,

but it will not reflect in GSTR3B.

kindly refer to this screenshot

Can you share the steps to replicate the issue?

This is a valid issue.

We will fix the issue and inform you once the fix has been released.

1 Like

Hello,

Fix has been released in v14.28.0 and v15.9.0 of the India Compliance App.

Kindly update ERPNext and India Compliance to the latest version to resolve the issue.

Regards,

Lakshit Jain