Hi there,

I have just started using the POS system and recently have been trying to figure out how best to handle in-store credit for customers who may return items after a 30-day period. It’s not clear to me how this is handled with the POS.

First, if I’m setting up a payment type of In-Store Credit, I presume that would get tied to a liability account, as it’s something the store owes someone in the future, correct?

Then, with the POS, most of the sales are to a “Guest” customer, so when a return of this sort is done, I will have to change/create a customer on the return form and then, do I just ensure that rather than going to ‘credit card’ or ‘cash’ I put in the negative value for the payment type of ‘In-Store Credit’? (Also, it appears we have to use the form view as something is off with returning multiple taxes properly straight in the POS - it initially pulls up the right return amount and then quickly adjusts, stripping out the 2nd tax on the item!)

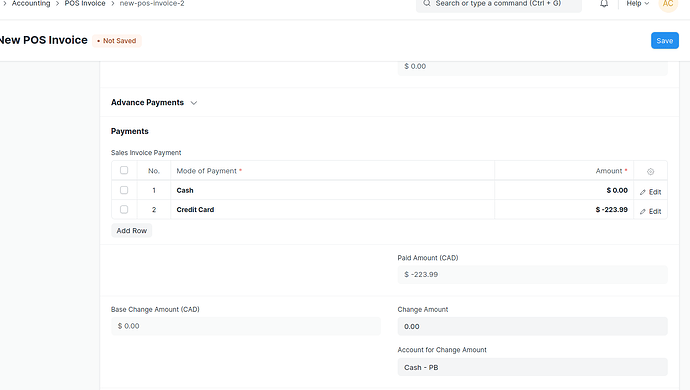

I’ve attached a screenshot of the return form view that I’m seeing (I haven’t added in the In-Store Credit bit yet as I wanted to try and ensure I did the right thing) - Account for Change amount wouldn’t change in my scenario?

ERPNext: 14.33.2

Frappe: 14.43.0

Thanks!