How do i opt profit and loss type account in the opening entry ?

You can’t. You need to use Temporary Account for this. I struggled with this a lot when we were migrating our data.

hey, how did you solve this one if I may ask?

Got sales from 2020, usually in my Trial Balance under Sales. I understand I can’t add that to the Opening Entry and need to use Temporary Account for this. How to make sure that the balance of Temporary Account gets to zero?

thanks

When these are paid, they will deduct from the temporary account until it is $0. If you have to write any of these off, just make sure you counter balance the write off account with the temporary account in journal entry accordingly.

Hello,

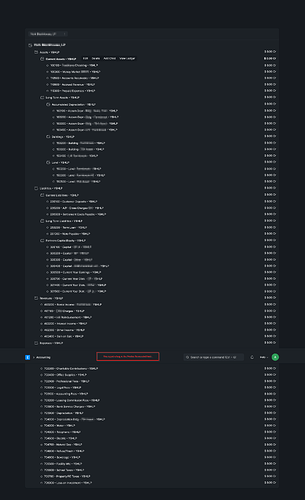

I’m really not understanding why I can’t just add Opening Journal Entries to Revenue & Expense accounts? I’m also receiving:

Journal Entry ACC-JV-2023-0000x: 'Profit and Loss' type account 'x' not allowed in Opening Entry

I’m just trying to load a basic property company’s Balance Sheet and Income Statement for both FY2021 and FY2022 from a legacy accounting system into ERPNext. But all the rules and barriers across this system are very frustrating to work within, and the error messages don’t describe how to take any corrective measures. I’ve loaded ALL of the Assets, Liabilities, Revenues, & Expenses into ERPNext’s Chart of Accounts, leveraging the built-in Root Accounts.

So if I only put my Assets & Liabilities into my Opening Journal Entry, it’ll end up as $0. -That’s all good. We’ll run a Balance Sheet in ERPNext and it’ll exactly match our legacy system’s report.

But where am I expected to input my FY2021 and FY2022 year-ending Chart of Account amounts for Revenues & Expenses such that I can successfully run a P&L Income Statement?