Hello all,

when i purchase asset, the expense account is not cost of good sold, it should be plants and machine expense, i can manually change it, is there a rule can automatically bring this account head in when the item is asset?

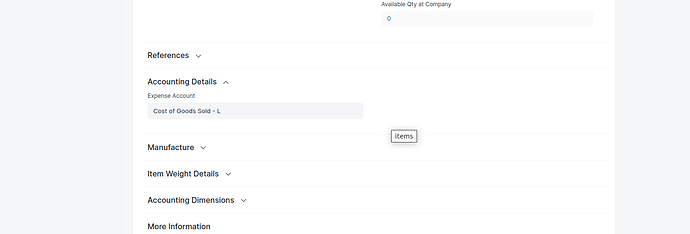

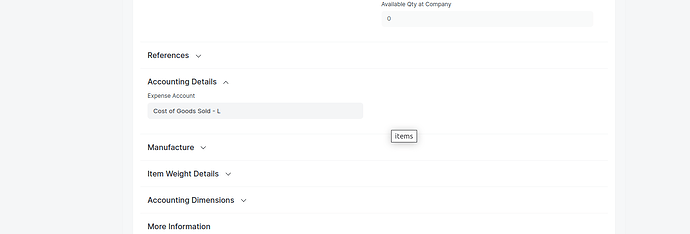

@RoyHu open the item , → accounting defaults and set your default expense account

@bahaou, thank you for your help.

i think i made a mistake here, the expense account is not necessary for asset purchasing. it should be the depreciation expense account(will be involved in depreciation process). so the snapshot above should be blank, am i right?

@RoyHu you configure both of them anyways . default depreciation account for asset is in the asset category

@bahaou, thank you. you are the solution, but

1,what’s the purpose of this expense account “cost of good sold” in the purchase order, it seems creating confusion here? when goes to the corresponding purchase receipt and purchase invoice, this expense account change to the correct accounts(stock received but not billed and plant and machineries if purchasing assets).

2, calling expense account/head , seems not correct, right? cost of good sold is a expense account, but stock received but not billed and plant and machineries are liability accounts