Hi everybody,

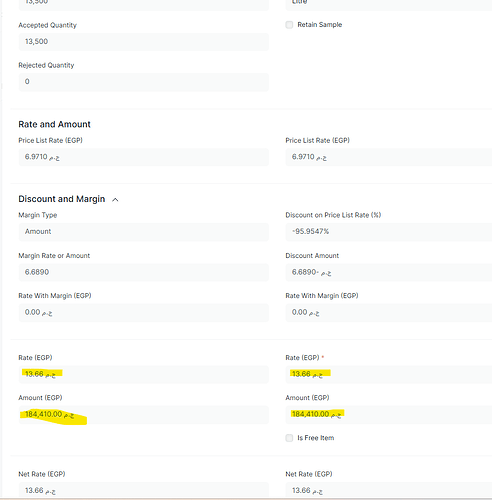

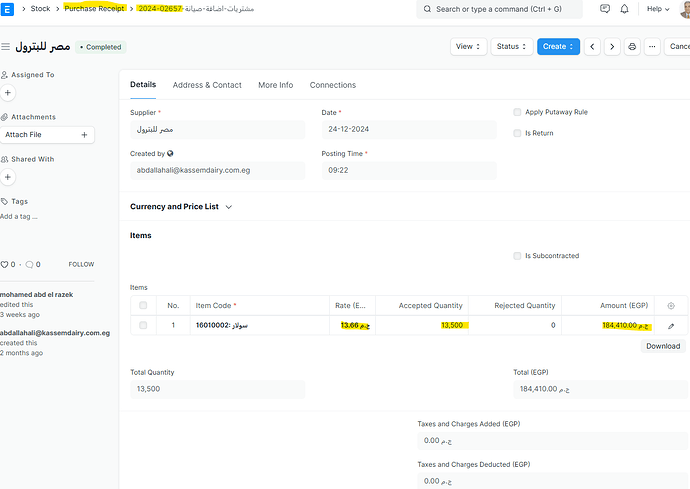

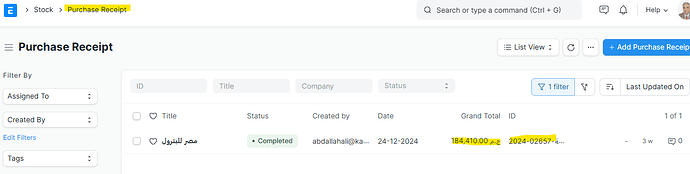

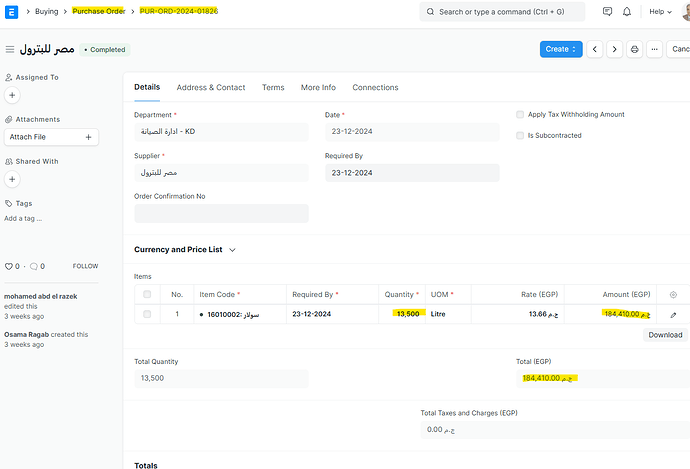

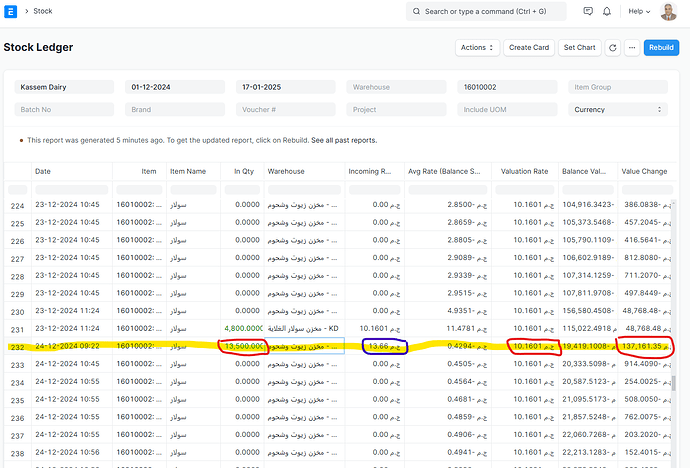

When I create a purchase order for an item for which the valuation method is FIFO, then I create a purchase receipt with the rate in the purchase order , I find that the purchase receipt stock ledger used a valuation Rate different than the rate entered in the purchase order and the purchase receipt. I deselected TDS , deleted old item prices, reposted item valuation … But all this could not fix the problem. Any help in this is highly appreciated.

NB: I am using erpnext v14.69 , frappe version: 14.74

Dear @Amr_Zahra

Possible to share few screenshots?

Dear @Amr_Zahra

So the story is about 13.50 to 13.66. Ummm!

Based on my understanding, in ERPNext, the valuation rate of an item can differ from the purchase rate due to 4 reasons, even when using the FIFO (First-In, First-Out) method.

Here are the 4 reasons for this discrepancy

-

Additional Costs - The valuation rate includes not just the purchase rate but also any additional costs associated with bringing the item into inventory, such as freight, taxes, and other charges. These costs are added to the purchase rate to determine the final valuation rate. Example - Landed Cost Voucher.

-

Previous Inventory - If there are existing quantities of the item in stock, the valuation rate will be influenced by the cost of these existing items. The FIFO method ensures that the oldest inventory costs are used first, but the valuation rate could be either one of the old stock or average - presuming FIFO method was not kept uniform.

-

Rounding Differences - Minor rounding differences can occur during calculations, especially if there are multiple transactions and varying rates involved. Silly reason, but still.

-

Physical Stock Verification & Reconciliation - If there have been any stock reconciliations or adjustments, these can also affect the valuation rate. Stock reconciliations adjust the quantity and value of inventory, which can lead to differences in the valuation rate.

This behavior is not a bug but rather a result of how ERPNext handles inventory valuation with FIFO.

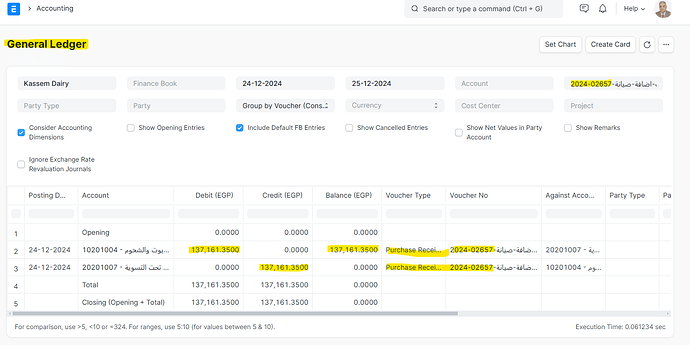

If you are still curious - extract the following

- you can check the stock ledger entries and

- you can check the valuation details for the specific item to understand how the valuation rate was calculated.