Hey @umair, I’m reopening this thread because I still with doubts

Relationed about the model of taxes that I was showed in the last messages, I have some doubts:

Suppose:

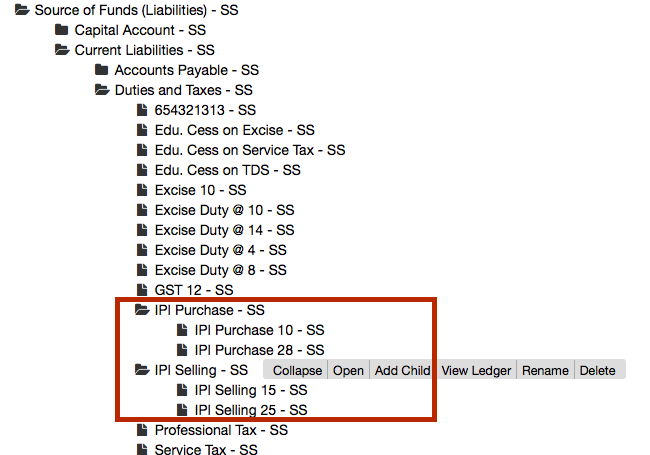

For IPI i have 2 sub-types - IPI Purchase and IPI Selling and above each I have many childs

IPI Selling 15%

IPI Selling 25%

IPI Purchase 10%

IPI Purchase 28% and others

So, the first question is how I can manage the Item Tax in Sales Invoices and In Purchase Invoices, if I only have one table in Item for write the taxes.

Second question is:

I have PIS and COFINS that are taxes attached to the head of Company, the PIS and COFINS only change between companies, is possible to manage that, and auto fetch it in a Item during the Item creation?

The third question is:

@rmehta, @nabinhait I think that this question is more apropriated to you two:

How i can change the way of calculation of the tax is made?

I my case I have too many vars to consider in the body of the tax, eg: Increase %, Decrease %, and the tax needs consider these variables based in a group of informational variables. (PS I know that the tax have the options Add or Deduct, but In many cases I need both)

I’m thinking if is possible manage the tax calculation using a hook. Maybe in tax master I can have one field that inform the hook that is used to compute the tax

Sorry Guys for my silly questions but the amount of  that is the brazilian tax system, can f*ck every good ERP.

that is the brazilian tax system, can f*ck every good ERP.

Note: In the link, you can see that in the item detail, I need create a Fold, and inside this fold are u seeing the basic variables to calculate the brazilian taxes in normal conditions, because based in another rules, I need hide or display many others groups of fields to use in tax. Crazy no