I’m trying to register the assets that we have invoiced but we have not received.

Accounts involved are:

2018 - Tarjeta Luis Banpro 8416 - IP (liability)

121-1 - Mobiliarios y equipos de servicio - IP (fixed asset)

1122-5 - Mobiliario y equipos facturados en tránsito - IP (assets Received but not billed)

The process we follow is:

- We create an purchase order

- We create a purchase invoice (This creates a debit in the fixed asset account and a credit in the liability account)

- We receive the assets (this creates a credit in the ‘assets Received but not billed’ and another debit in the Fixed asset account) which produces to have the asset value duplicated in the Fixed asset account.

If I do the receipt first I get the debit and credit in the ‘assets Received but not billed’ and one debit in the fixed asset account but that’s not how things work.

I need to create a account that registers that supplier owns us products, since they doesn’t ship without us paying.

I can do this process with the stock accounts, I use the ‘Stock Received But Not Billed’ and it allows me to Debit that account with the invoice and then credit it with the ‘purchase receipt’. In this case the account should not be a liability but a assets since it represents that the supplier owe us inventory.

How can I register the process described in fixed assets?

After the Invoice, if you create a Receipt, it should not create an entry in the “Asset Received but not Billed” account. That only happens when you create a Receipt without an Invoice. (When there is no linking between the Receipt and Invoice).

Please check whether you’re creating the Receipt from the Invoice (via the Create Purchase Receipt Button in the Invoice).

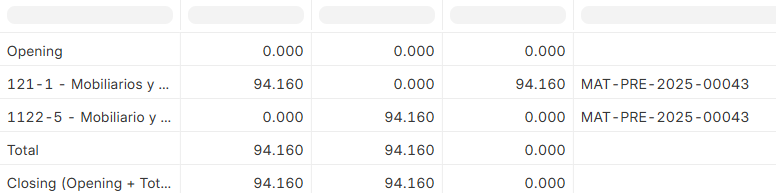

This is the accounting ledger after creating the purchase receipt from the Invoice:

121-1 is a fixed asset account

1122-5 is the “Asset Received but not Billed”

I get the exactly same result if I create it from the purchase order. As result I have 2 debit in the fixed assets account

So what I need to do is to create an account and make the software to debit that account when I create the invoice and I have not received the asset.

I tried moving the 1122-5 account to a ‘‘fixed asset’’ and creating 2112-4 to be the “Asset Received but not Billed” account but what ever I do it always uses the “Asset Received but not Billed” account to credit and the set ‘‘fixed account’’ to debit in Purchase receipt.

Does the ‘‘Allow Purchase Invoice Creation Without Purchase Receipt’’ setting has something to do with this?

Please, let me know if you need any further information. I had prepared a better post with ss but I’m not allowed to post more than 1 image since my account was created recently