Subject: Request for Assistance with Landed Cost Voucher and Tax Calculation in ERPNext

Dear ERPNext Community,

In Ethiopian taxation, the item tax is calculated after the Landed Cost Voucher has been prorated and the applicable amount distributed. This affects the taxable amount in the Purchase Receipt tax calculation. The Landed Cost Voucher amount for an item is added to the item amount, and then the tax calculation is done based on this.

I understand that this functionality is not available by default in ERPNext and that I might need to customize my setup or write a custom script to achieve this. However, I am not sure how to go about doing this and would appreciate any guidance or advice you can provide.

Thank you in advance for your help.

1 Like

Firstly when you ask such questions, adding a few examples with numbers or mapping out the accounting entries does help understand the requirement better.

I am assuming that there is some taxable charge like Freight and Forwarding charges which are unknown at the time of booking Purchase Receipt and later you are posting a Landed Cost Voucher for it.

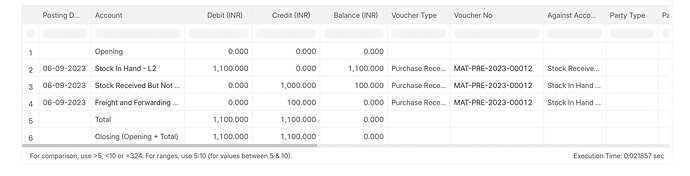

Here only one item was added to the Purchase receipt which had a base rate of 1000 and then an LCV was posted for adding charges of 100

This is how the accounting entries look once the PCV is submitted and the taxes do get booked on the Purchase Receipt

The taxes do get added to the purchase receipt. You’ll have to elaborate more on your question for us to give further suggestions

2 Likes

Thanks for sharing this example. It would help me clear some confusion (and perhaps be useful to the forum) if you can also illustrate how LCV is different than say an item/account affecting inventory valuation? Is it possible to create a workflow / account / item called Inbound Freight whose expense is automatically added to the inventory valuation? So this expense will only be deducted as the goods are sold (not when incurred). Or the recommended route in ERP is always via LCV? Import tax, duties etc and exchange rates are often dictated by local customs authorities - only route for those to be booked is via LCV?

Purchase Taxes and Charges/Landed Cost Voucher processing when you have a line in Purchase Taxes and Charges with Consider Tax or Charge for is set to Valuation and Total is a pain point.

Consider the case where you have costs over the item net value either rated or actual to be added by ERPNEXT when the Purchase Receipt is processed. This especially is crucial when these costs are denoted on the Purchase Invoice say an import invoice. When you add Landed Cost Voucher on that Purchase Receipt the calculation process produces wrong Accounting entries.

I will be more than happy to assist the bug team on a case.

@Abenezer_Asefa this behavior is expected especially in import operations. The base Purchase Invoice and maybe supporting documents hold the import invoice information and related costs to be included at customs for taxation. Since these cost items are not from a single Supplier and in some cases even appropriated by the government, it does not make any sense of any ERP logic to include them in a single Doctype.