@Mohammed_Anas1

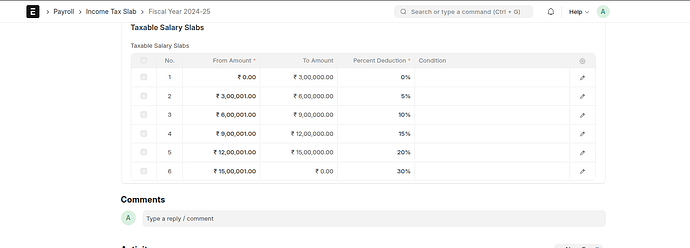

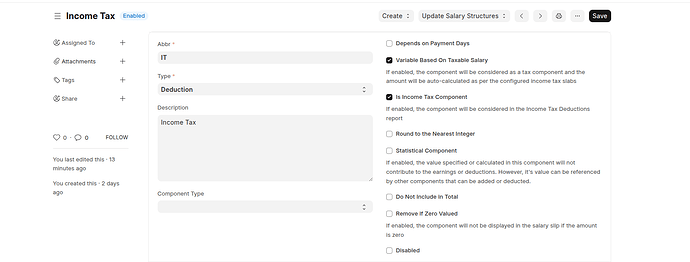

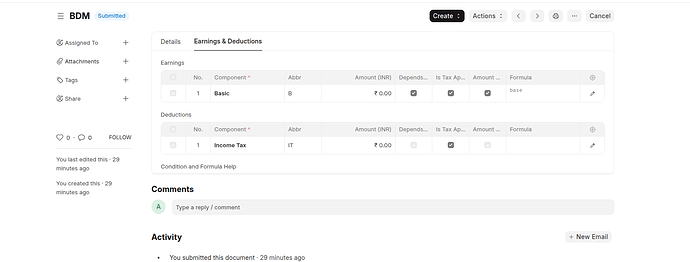

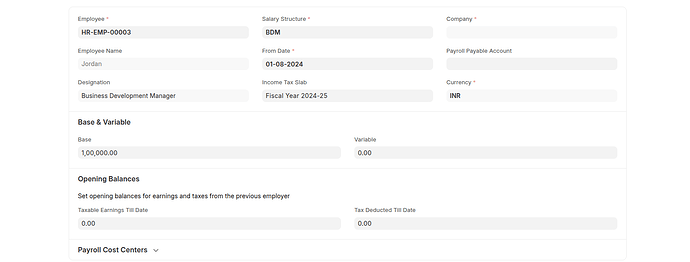

Based on the given income tax slabs:

- ₹0 - ₹3 lakh: No tax (₹0)

- ₹3 - ₹6 lakh: ₹3,00,000 × 5% = ₹15,000

- ₹6 - ₹9 lakh: ₹3,00,000 × 10% = ₹30,000

- ₹9 - ₹12 lakh: ₹3,00,000 × 15% = ₹45,000

Total income tax: ₹0 + ₹15,000 + ₹30,000 + ₹45,000 = ₹90,000

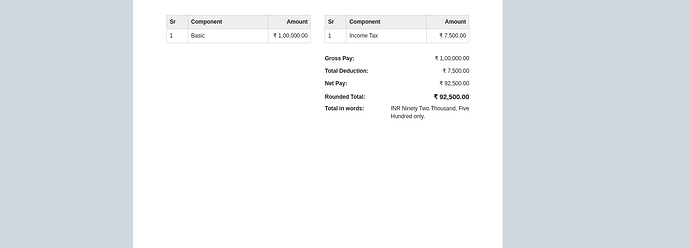

Monthly income tax: ₹90,000 ÷ 12 = ₹7,500

For the current month, the tax payable is ₹7,500.

The remaining tax for the year is ₹90,000 - ₹7,500 = ₹82,500.