Dear Team,

I have a doubt in the purchase invoices and sales invoices general ledgers-

When we pass a standalone Purchase Invoice, the system records only the purchase transaction, the system does not record the entry for Purchase Receipt.

On the other hand, when we pass a standalone Sales Invoice, the system records the entries along with the Delivery Note as well, which means a total of 4 entries are recorded together while passing the Sales Invoice.

Can someone pls explain me the logic and reasoning behind this ?

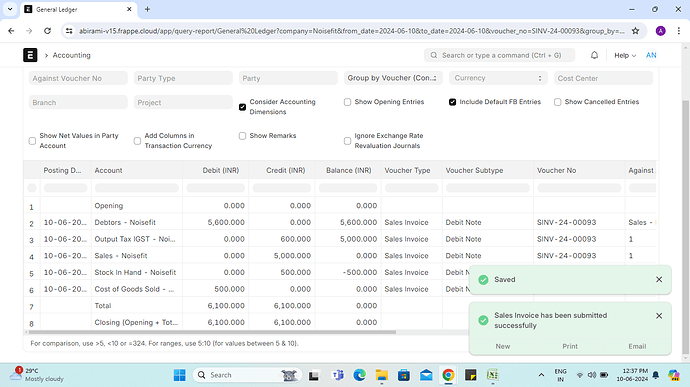

This is the screenshot at the time of passing a SI (this shows SI as well as DN entry)

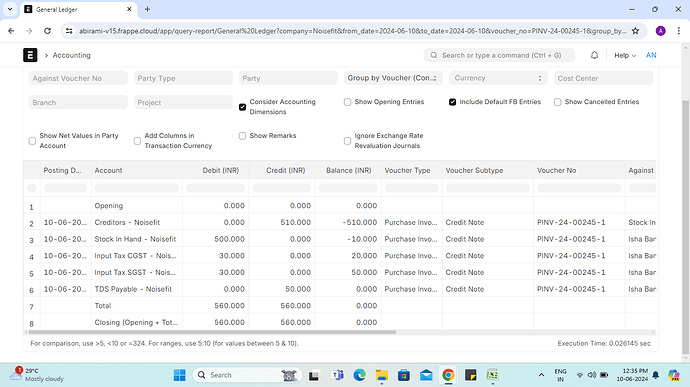

This is the screenshot at the time of passing a PI (This shows only PI entry, PR is not shown)

If Update Stock is Checked in sales invoice then system will make stock ledger entry along with accounting entry. Same applies with purchase invoice.

Make sales invoice without checking Update stock and check general ledger.

Dear @Akshay312 ,

Thank you so much for responding to my query, but my query is little different.

Update Stock option is selected at SI and PI both, but in the general ledger of PI, the entries of PR are not reflected

Okay. In P2P cycle cost of material is required to be record for both Accounting and stock. But in case of Order to Cash COGS(Expense) and Sales (Revenue) required to be accounted so

COGS ____________dr

To Stock in Hand

This for booking Direct Expense and

Debtors__________Dr

To Sales

This is for booking revenue

For this 4 Entries are created in GL if update stock is checked in sales invoice.

@Akshay312

Thank you so much for responding to my query and clarifying the same.

From your msg I have understood that -

For O2C- we need to show the expense entry as well as the revenue entry and that is why the system record 4 entries together, while in case of P2P, the entry is only for the accounting and stock, and that is why the system records only the purchase entry.

Thank you so much for the clarification Akshay!!!