Greetings, hope you are doing well.

We require assistance for manipulating tax calculation as below, we are using ERPNext: v10.1.73

Currently we are discussing Sales Tax for Service Items.

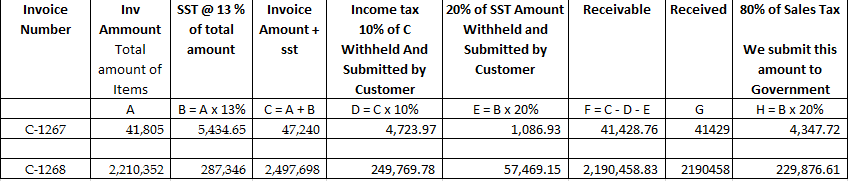

Following two taxes applied on each sales invoice

First Tax:

Sales Tax ----- A = Invoice Amount x 13%

Sales Tax = 13 percent of invoice amount

Second Tax

Income Tax ---- B = (Invoice Amount + 13% of Invoice Amount) x 10%

Income Tax = 10 Percent of (Invoice Amount + Sales Tax)

Case 1

20% of A is withheld by our customer, and submitted to Government dept SRB.

80% of A has to be submitted by our company to the Government dept SRB.

Income tax is withheld by our customer and submitted to Government Dept FBR.

Case 2

100% of A has to be submitted by our company to the Government dept SRB.

Income tax is withheld by our customer and submitted to Government Dept FBR.

Please guide how to implement in ERP NEXT, Thanks.