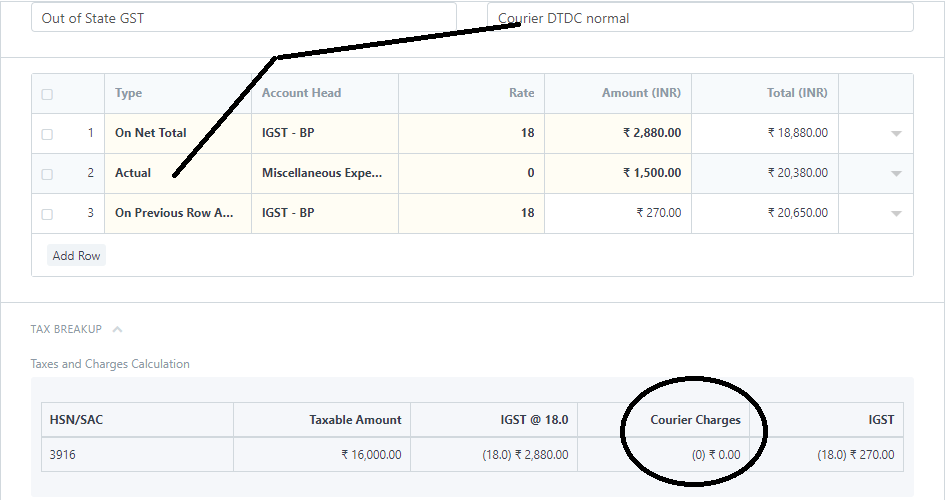

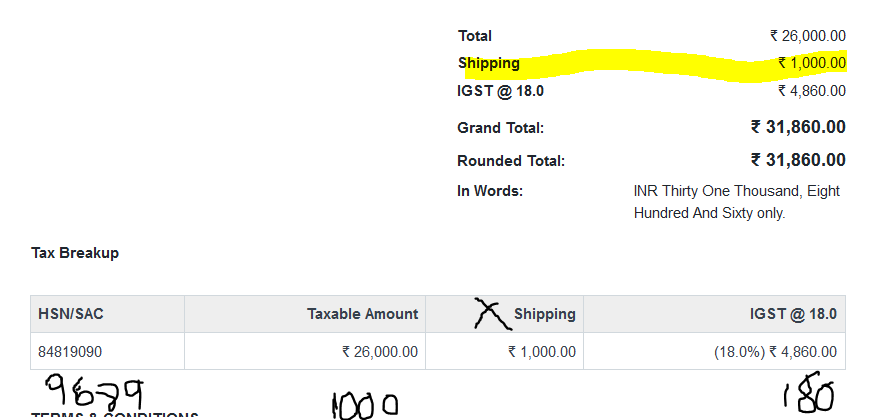

After adding the Shipping charges in the tax breakup the shipping charges are shown as 0 due the rate multiplication but i required shipping charges should be displayed as it is Because of the GST Billing Requires Separate field for the Shipping and its Taxes

Any Suggestion on the above Issue ??

Is it needed to display shipping charges based on HSN codes? I think GST is applied on courier charges as well and it has it’s own SAC code. In that case, you might need to track shipping charges as item.

Ok , that way is possible

Even then the actual multiplication factor should not be 0 in the tax break up right ? any rate multiplication with 0 will give us a 0 , So, whatever the actual charges in the tax break up it will be shown as 0 . So , if we can adjust the script of the tax breakup such that it reflects the actual amount ??

Please create a github issue for showing actual tax amount in tax breakup.