Hello there,

Setting up the company there is a need to have Default Payroll Payable Account defined linked to one of the accounts in the Chart of accounts.

Reading several other posts on the forum I have learned that this account should be a Liability account. I get that it might be like that but… here in Portugal it is not.

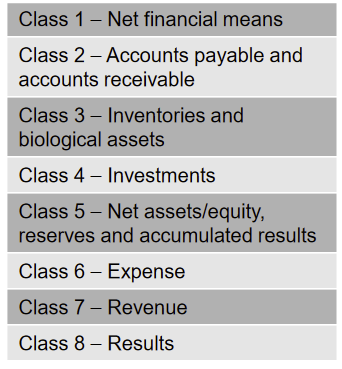

Very brief intro:

Chart of Account main classes

check source for additional info: Multidimensional Chart of Accounts: The Portuguese Experience

The Account Group Types are:

- Asset

- Asset

- Asset

- Asset

- Liability

- Expense

- Income

- Liability

Well the issue in this particular post is that payroll accounts are of class 6:

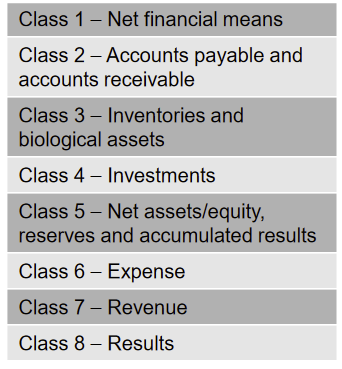

See extract of my COA from erpNext’s accounts list in the reply of this post as I can’t yet put more than one embedded image in posts.

Translation is:

6- Expenses

63 - Expenses with personnel (workers, staff, directors, etc…)

632 - Personnel salaries

68 - Other expenses

682 - Ready payment discounts conceded

686 - Expenses in the remaining financial investments

6863 - Differences in unfavorable exchanges

etc…

This begs the question:

“Does this mean I can’t do payroll management in erpNext for Portugal?”

Thank you for any clarification.

P

1 Like

The image I coudn’t post in the previous post:

What type does the payroll account need to be as per Portuguese laws and standards?

You can set up the accounts for individual components at the Salary Component level. This is for both earnings and deductions like tax and other social obligations (social security/PF/insurance).

Payroll Payable (root head: expense) is used when the Journal Entry is created for accrual:

I don’t know exactly what the case is, but Payroll Payable Account is there to record how much the company need to pay As Liability, and the other side are accounts in Salary Component

EX:

- In Salary Complainant

Basic, set account to Salary which is Expenses Account Type.

- when Submitting Payroll Entry and Salary Slips, A Journal Entry like this will be Generated:

| Account |

Debit |

Credit |

| Salary |

1000 |

|

| Payroll Payable |

|

1000 |

Which record 1000 Expense on company As Liability to employees which has to be payed.

- On Paying Employees using for example Make Bank Entry button on Payroll, you will have Journal Entry like this:

| Account |

Debit |

Credit |

| Payroll Payable |

1000 |

|

| Bank Account |

|

1000 |

Which demonstrate that, there is no more Liability on Company.

the final result will be:

-

Expense on Company : 1000

-

Liability on Company : 0

-

Bank Account : loss 1000 (Which Payed to Employees)