Hi … users ERPNext…Hope you all are fine and doing good.

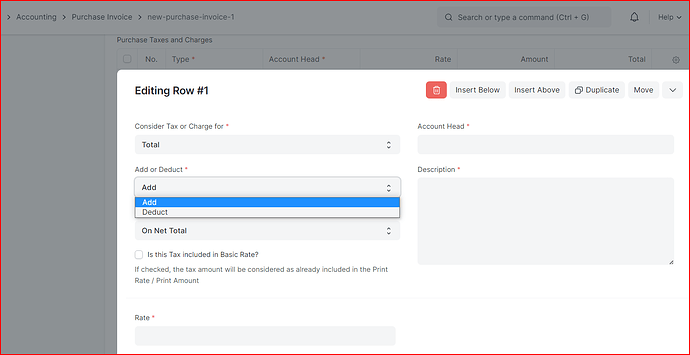

I want to know about Tax withholding category for customer (selling module). Is there any way to show same option (in sales invoice) to add/deduct tax amount as in purchase invoice?

Actually I want to solve this simple scenario at SI.

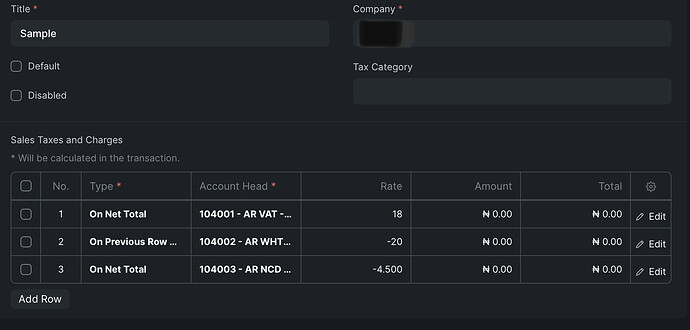

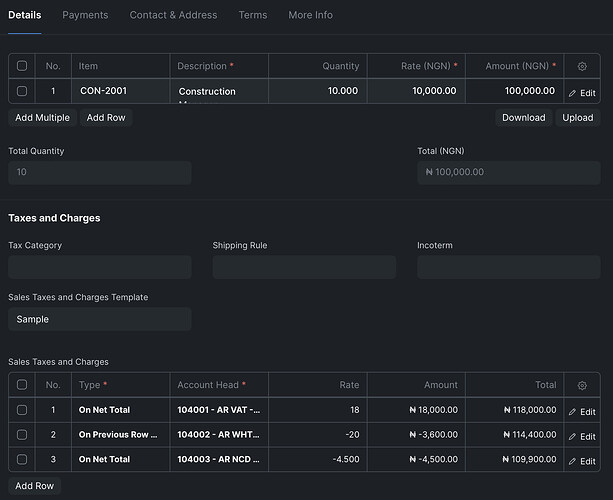

Suppose I sell 10 items @ rate of 10,000 = 100,000

GST 18% = 18,000

GST Tax wittheld (20% aginst 18000) = (3,600)

IT Tax withheld (4.5% against net.T 100,000) = (4,500)

Grand Total = 109,900

Any solution with sales invoice-screenshot would be appreciated. Thanks