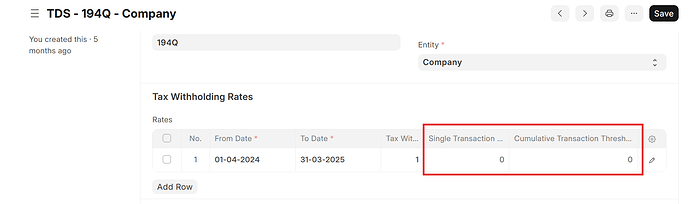

I set both Single and Cumulative Transaction Thresholds to zero in my Tax Withholding Category to ensure that taxes apply on every transaction. However, the Purchase Taxes and Charges are not calculated for the assigned supplier. How can I resolve this issue to ensure TDS is applied correctly?

To apply taxes on every transaction for a supplier, I found that leaving the Single and Cumulative Transaction Threshold fields blank didn’t work as expected.

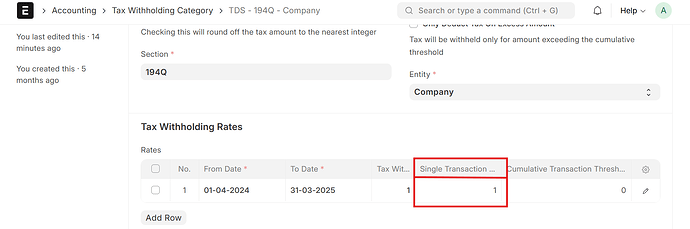

So, I set a minimal threshold value (like “1”) for the Single Transaction Threshold, which does calculate taxes on each transaction.

However, this doesn’t seem like a standard approach. Is there a any standardized way in ERPNext to apply taxes on all transactions without setting a threshold value?

1 Like