Hello Guys!

A client opened the system (Started using it) in the last quarter of 23-24. (Jan-Mar)

-

All the openings have been carefully created.

-

Party Masters and their opening have been created.

-

Tax Withholding category is created. (For 194Q TDS on Purchase. Commutative threshold 50,00,000, 0.1% on Excess Amount).

-

For Supplier A , The opening balances were 0 and no opening invoices were there. But in the same financial year (last 3 quarters) total purchases were of 1,00,00,000

-

When I try to raise a purchase invoice of 10,00,000 in the new system, the system can not apply the tax withholding because the threshold does not match.

-

The Reason - The system does not have any way to know that a commutative purchase of 1 Cr has been done in the name of this party.

Any expert advice or do we need to have it customised?

Thank you for your support.

Hi @aa_prashant ,

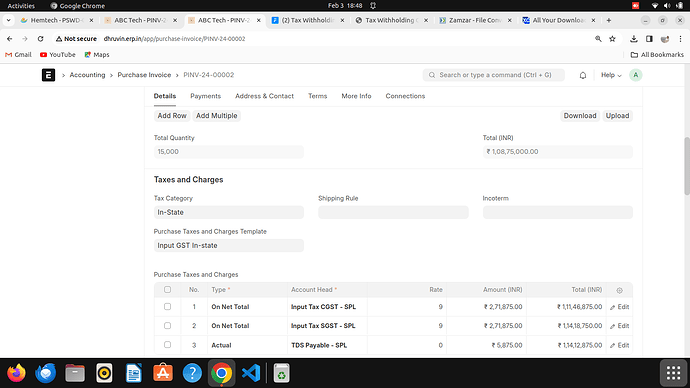

I have created a new supplier. You can see a time in a screenshot. I have also Created a new tax category for 194Q on TDS Purchase . So its a new supplier and same as you have no any opening balance for that supplier or even no any opening invoice created. As per your case I have created a first purchase invoice for that supplier and TDS is calculated. When you mentioned a cumulative threshold in a tax category then even after if you are make a invoice for out of that threshold system will calculate a TDS or suppose You have created 5 Invoice for that supplier like first one is for 200000 each then that 5 invoice will not calculated TDS but when you create a 6th Invoice for whichever amount it will heat the threshold and TDS will be calculated.

Hope this will help as per my understanding with your case.

Thank You

1 Like

Hi Dhruvin, Thank you for replying.

I Understand that the cumulative threshold considers the total of all the invoices for a party.

My Issue here was when My System was started on the 1st of January.

Although the party had crossed a 1 cr purchase there is no way to tell the system if I do not have any openings for that party.

There should be a doctype called “Lower Deduction Certificate”.

Try creating one with the exact opening invoice value as the certificate limit, and then creating a new invoice to see if the TDS is set.

1 Like

Have you tried it recently? @Void_Moon

Hi @Void_Moon and @aa_prashant ,

Lower Deduction certificate is a Certificate that is issued by the Income Tax Department in India, allowing a taxpayer (usually a supplier) to be subjected to a lower rate of Tax Deducted at Source (TDS) than the standard rate. It helps reduce the upfront tax burden for suppliers, improving their cash flow.

Suppose Standarad Rate for rent payment is 10 % and Supplier has an LDC with a lower rate of 5% then You have to Create an LDC in ERPNext with the supplier’s details and the 5% rate. So When you create a purchase invoice entry and making a rent payment to the supplier, ERPNext applies 5% TDS instead of 10%. There will be no other use on LDC.

@Void_Moon and @aa_prashant using LDC will not be solved your problem.

@aa_prashant In Your case you have not Created a any Opening Invoice for Supplier A, So system have no any Commutative Sum that heat the threshold. So basically You have entered in to system in the Middle of the year like in Jan then we have to tell the system, how much of purchases were done in to the last 3 quaters. We have no another way to tell the system of how much Purchases were done. As per my understanding you have to make a entry for the opening Invoice of 1 cr first for last 3 quaters and then when you create a purchase Invoice entry of 10 lakh in Jan then TDS will be Calculate automatically. There are no other ways to tell the system as per my understanding.

I hope this will help.

Thank You !

2 Likes