Hello Team

Here is the scenario

Item A and Item B fall under 5% GST, while Item C falls under 18% GST.

So I have created Sales Taxes and Charges Template accordingly and have applied an Item Tax Template for Item C.

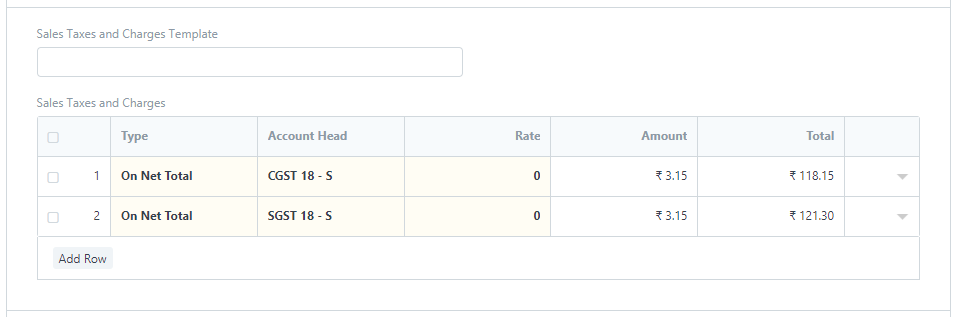

In the sales order containing these three items, as soon as I add Item C, the table ‘Sales Taxes and Charges’ gets auto populated (as Item C has been provided with the Item Tax Template). [Pic below]

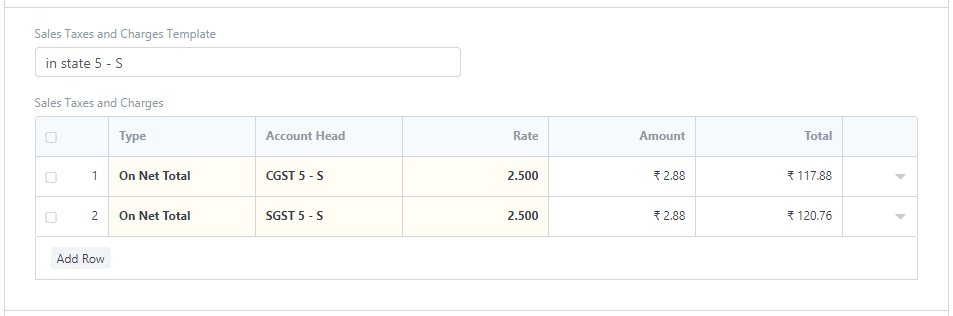

However, in order to apply tax rates for Item A and Item B, as I select corresponding Sales Taxes and Charges Template, it completely over-rides the Item Tax template of Item C and tax rate from the sales taxes and charges template are applied to all the three items. [Pic below]

Am I wrong in my approach? Please advise.

Thank you.