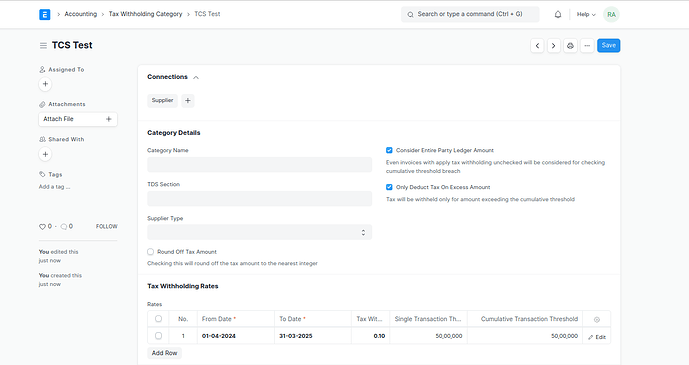

I want to calculate the TCS for the supplier, including the GST amount. I have tried setting it in the tax withholding category in the supplier, but I need to calculate both TCS and TDS in the purchase invoice. If the supplier has crossed 5,000,000 in the financial year, then I need to calculate 0.1% for that invoice. Is there any way to do it?

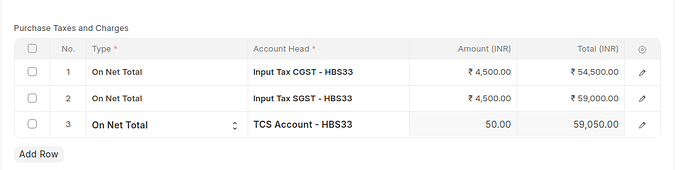

Thanks for your response, But I don`t have any issues in TDS calculation but i need to track all invoice of particular supplier and add TCS automatically with GST amount when the supplier crosses 5000000. In the Below Image I have added the TCS Account Manually but the expected flow is it should added automatically.

Currently, TDS amount is calculated on tax_withholding _net_total which is based on Net total.

TDS on Gross Amount is not Supported.