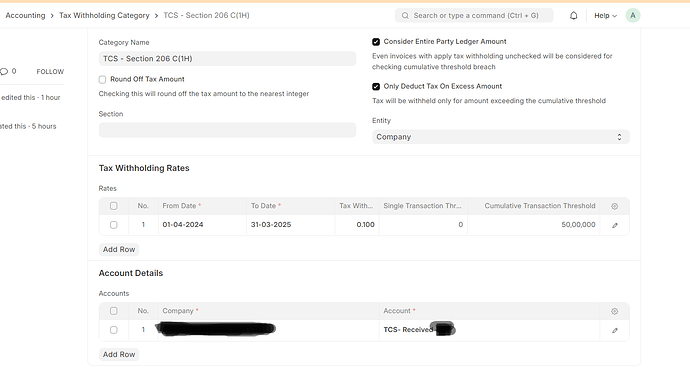

I have set up TCS in the tax withholding category with a cumulative transaction threshold of ₹50,00,000.

After this setup, I created two purchase invoices using the tax withholding category.

- The first invoice did not reach the threshold, so TCS was not calculated, which is correct.

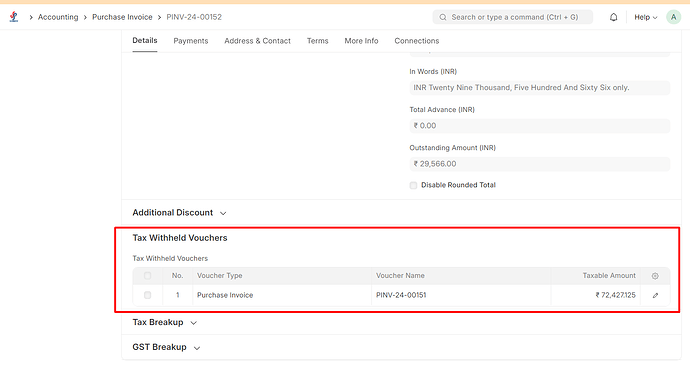

- However, the second invoice did reach the threshold, but TCS was still not calculated.

Could you explain why TCS was not calculated for the second invoice?

Hint: The second invoice includes a child table showing tax-withheld vouchers, which references the first purchase invoice number.