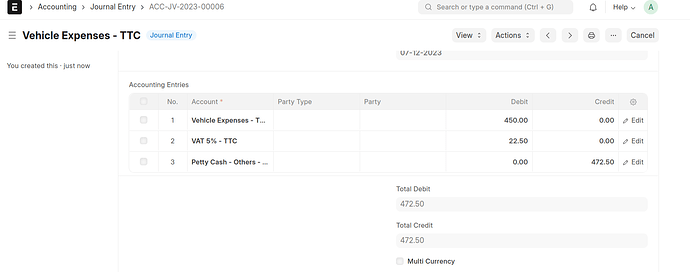

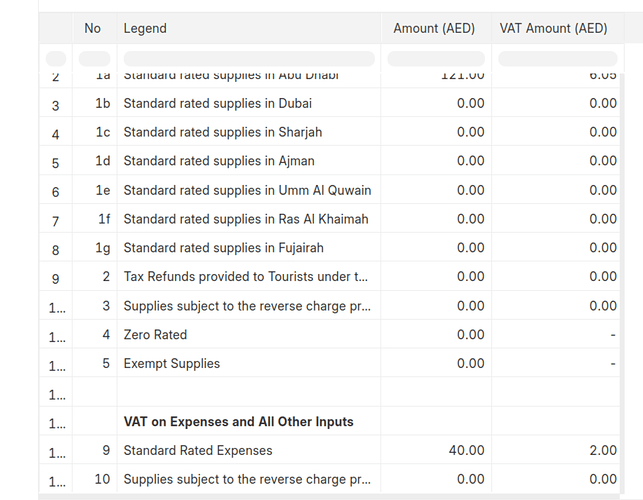

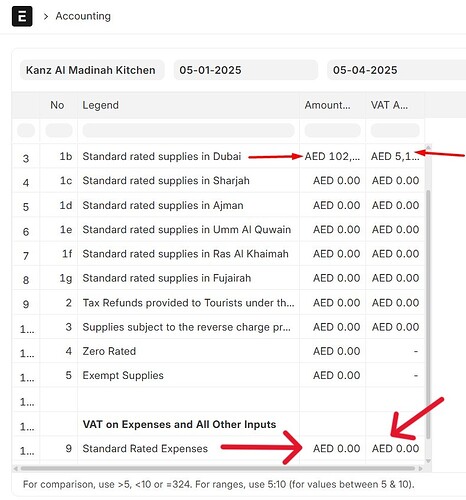

In the UAE VAT report the Sales and purchase transactions show up fine, but when it comes to expenses recorded through Journal Entries, they’re nowhere to be found in the VAT on input and other expense sections of the report. For example I recorded a vehicle expense via journal entry as shown in the image below but in VAT report that expense is not reflected.

Is there a specific setting I need to adjust to get Journal Entry expenses to show up in the VAT Report?