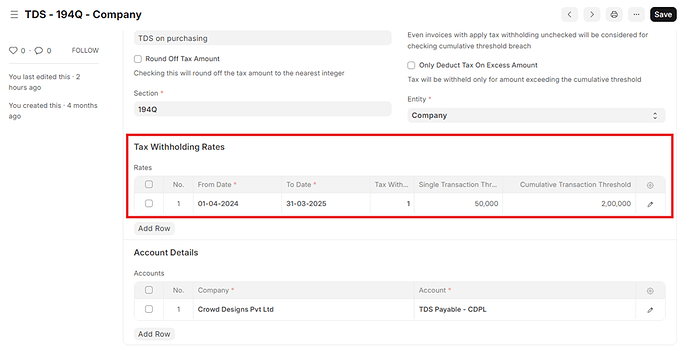

I have set up a Tax Withholding Category with the following parameters:

- Tax Withholding Rate: 1%

- Single Transaction Threshold: 50,000

- Cumulative Transaction Threshold: 2,00,000

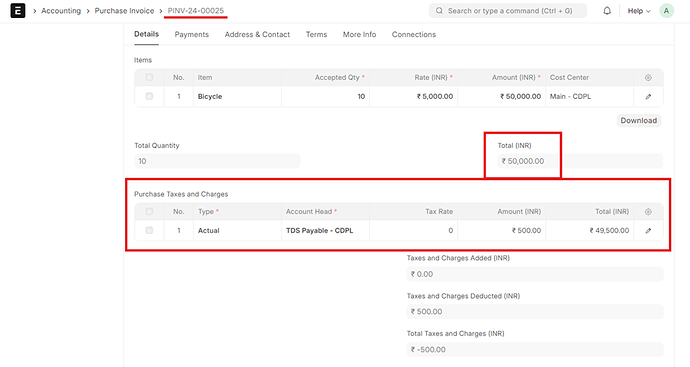

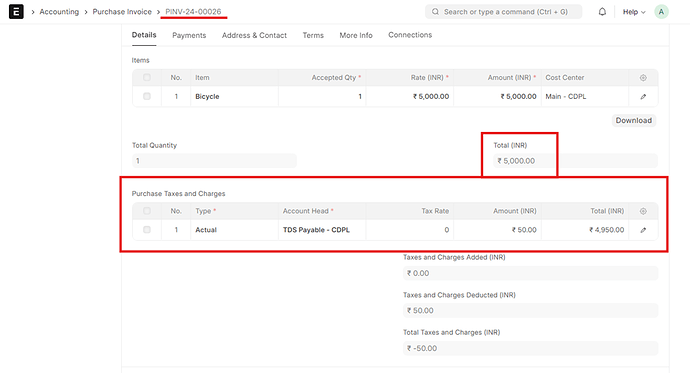

After creating my first purchase invoice for 50,000, TDS was correctly deducted because it met the single threshold. However, when I created a second purchase invoice for 5,000, TDS was also deducted, despite the amount being below both thresholds.

Purchase Invoice - 1:

Purchase Invoice - 2:

Could anyone please help me to clarify why TDS was applied in this case?

Thanks in Advance!