Hiii

Although I set the Default Valuation Method as FIFO, but the system calculate the Valuation as Moving Average???

Please clarify…

Hi,

On ‘Item’ master form ,Have you been set Valuation Method?

Valuation Method globally for all the items from Stock Settings. i think on Item master you may be set “Moving Average”

Hi @shraddha

In item master list Valuation Method is not appears,

When I open the item list with customize option I found this field??? I already checked maintain stock

Can you check Valuation Method set for this item from Report Builder? The Valuation Method field is only available when creating new Item.

Dear @umair

I can not change the validation method for already created items and they are taking action as Moving Average method Although I set it in default stock setting as FIFO.

My question why take action as Moving Average while I set default as FIFO?

Regards,

Did you check Report Builder for an Item with Valuation Rate column? If yes, what was the valuation rate updated for that Item? It is very much possible that for this particular item, valuation rate was specifically updated to Moving Average. In that case, valuation rate mentioned in the Item master will be given preference. An screenshot of report builder with Valuation Method column in it.

Good morning @umair

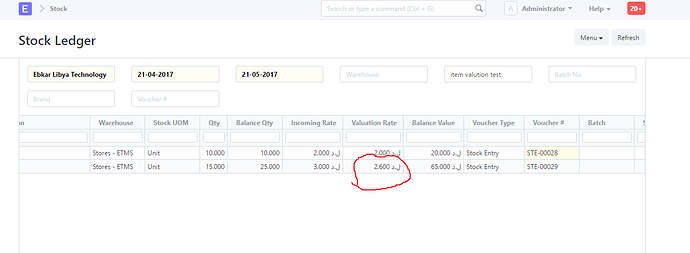

Please see the following screenshots:

There is no any valuation method set and take action as Moving Average

Was this resolved? I am getting constant “Valuation rate not found” errors even though valuation is set…this is a very confusing situation

What is ERPNext version

Version

9.2.15

Hi, This seems to be still an open issue. We have also set default valuation method in ‘Stock Setting’ as ‘FIFO’ however it is calulating based on Moving Average.

The valuation_method field in item master is blank.

Hi, I’m also wondering why no it is still not resolved? FIFO isn’t working at all.

@fnrfarid we realised that FIFO valuation is followed indeed. The valuation_rate in the Stock Ledger Entry is the valuation of the stock which is in balance at the warehouse and not the stock which is sold as part of that transaction.

We changed valuation method for each item to Moving Average and adjusted stock by entering dummy Purchase Receipt at the start of the time and then cancelling it. This will repost all the ledger entries.

There are still some corner cases like stock transfers from one warehouse to other which would have impact on the valuation rate.

Anyway, to conclude, FIFO valuation is correct. It is just that the valuation is of the item quantity available in stock and not the one which were sold.

Hi Sachin,

Thanks for your feedback. Unfortunately and sadly I’m not any expert. I’m not quietly sure I understood what you tried to say.

One of my colleagues told me that, ERPNext’s system of valuation seems fine though I’m pretty sure I found this post as I felt something is feeling right.