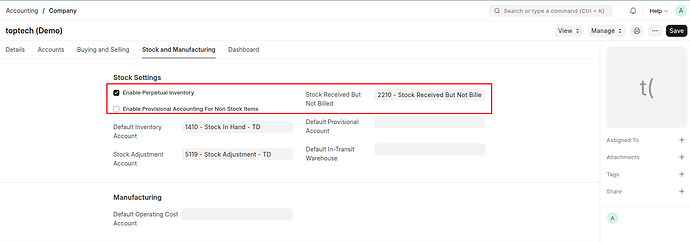

As I understand, when Perpetual Inventory is enabled, ERPNext creates GL entries upon delivery or receipt of items.

- On the purchase side, when submitting a Purchase Receipt, the system credits the “Stock Received But Not Billed” account.

- Then, when the corresponding Purchase Invoice is created, that account is debited to clear the balance.

However, on the sales side, after submitting a Delivery Note, there is no equivalent account like “Goods Delivered But Not Invoiced”. Instead, the COGS is recognized and inventory is reduced, but nothing is posted on the revenue side until the Sales Invoice.

I’m trying to understand:

Why does ERPNext handle the purchase and sales sides differently in this case?

1 Like

I’m definitely not an accountant, but I believe the way that ERPNext does this is correct. The stock transaction is already being covered by the COGS entry, and no other change in accounts would be expected until income is recorded.

The Stock Received But Not Billed account is necessary because otherwise you have inventory in your stores that isn’t reflected in your accounts. That’s not the case with outbound delivery, where the change is reflected in your stock accounts/cogs.

2 Likes

Thanks @peterg

So, on sales sides there’s no point to record entry in account like “Goods Delivered But Not Invoiced”, as you said it already covered by COGS

That’s how it works where I am, but in the end this is a question for your accountant or auditor.

Ok, actually I’m in developer team and I just come to this framework.

and BA team have discussion about this topic.

After observe in code there no function to support what I ask in sales side too.