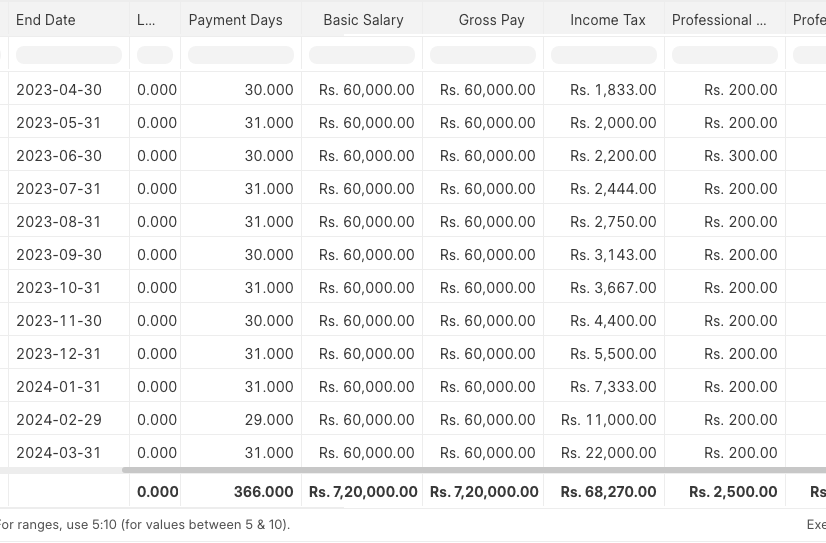

Hello experts, I want to implement salary from 24th to 23rd. Have set the payroll period from 24th April 2023 to 23rd March 2024. For the Salary calculation there is no problem. But I am not getting the Income Tax calculation as expected. The cumulative CTC which gets calculated for 12 months comes around Expected CTC + 12 Days CTC.

Someone, kindly educate me If I am missing something important or the ERPNEXT cannot handle such scenario yet.

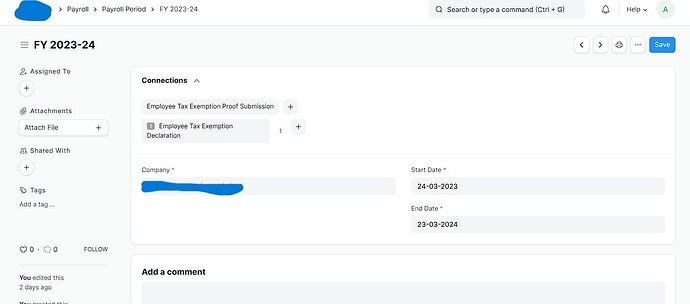

Payroll Period :-

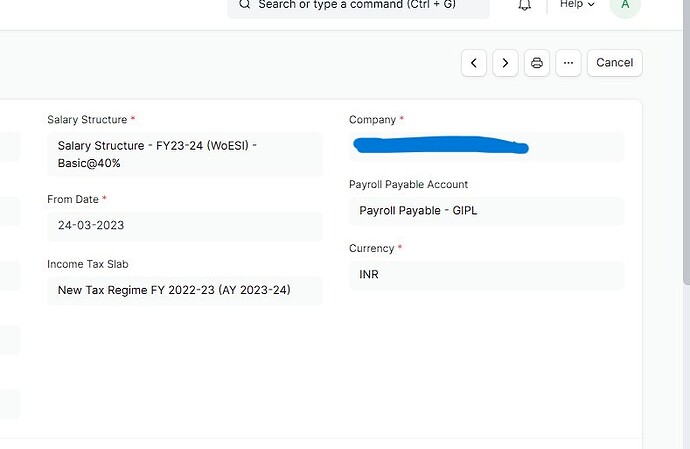

Salary Structure Assignment:-

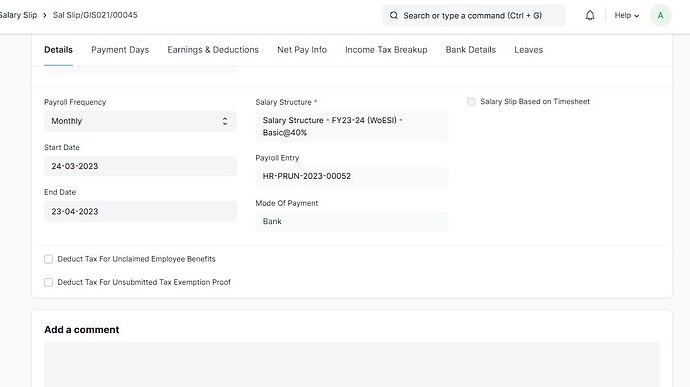

Trying to generate Salary Slip for the period of 24th March to 23rd April:-

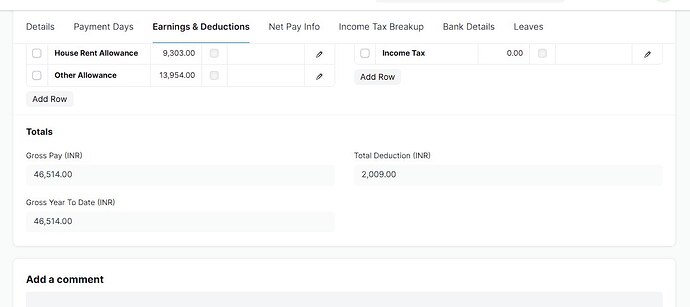

Salary slip where Gross Salary is calculated for the month:-

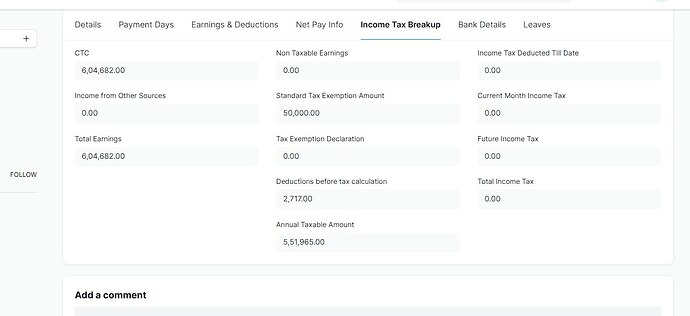

Wrong CTC Calculated in Income Tax Tab

Expected value in CTC 46,514(Gross) x 12 Months = 558,168

Thank you in Advance