Hi everyone,

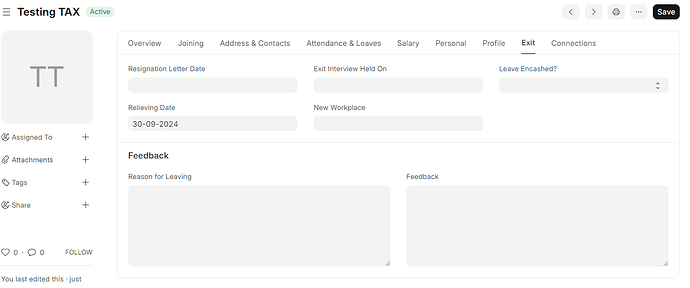

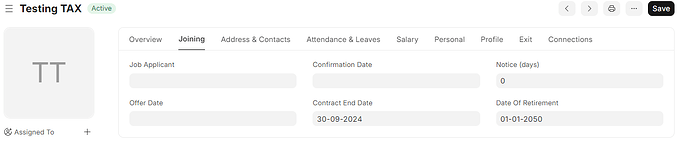

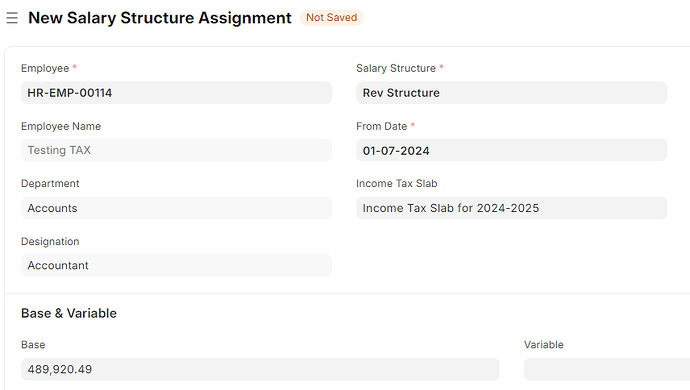

How can I accurately calculate and deduct income tax for a contractual employee with a three-month employment period in FRAPPE HRMS? The current system is calculating tax based on a 12-month salary, which is incorrect. I’ve tried using both the ‘Contract End Date’ and ‘Relieving Date’ fields, but neither has produced the desired results. Can you provide specific instructions on how to set up the employee record and payroll settings to ensure correct tax deductions for contractual employees with short-term employment?

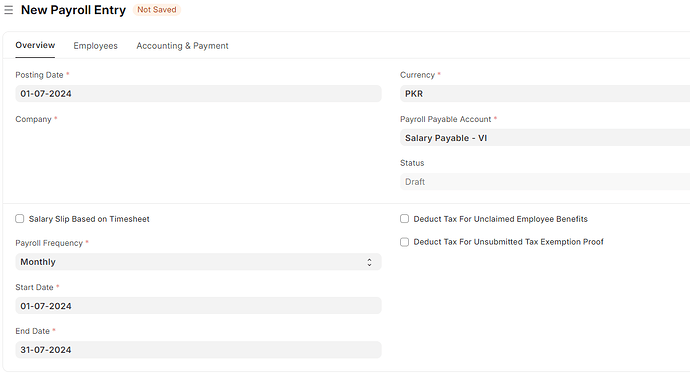

What i did for the employee is that in July 2024 i created a payroll entry with Payroll Info > April 2025 to calculate only 3 months tax and it was correct. I can’t do that for all the contract employees as most contracts are about to expire in OCT 2024, and Nov 2024.

Has someone has done this or is it a bug in calculations?

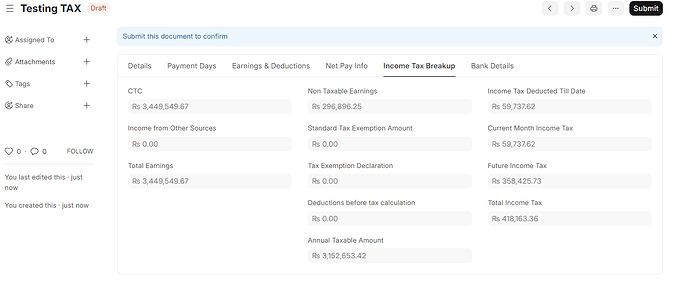

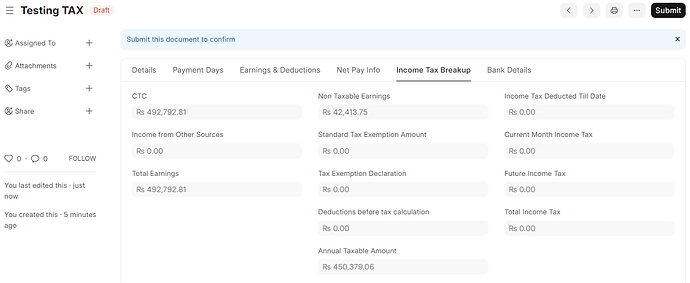

Look at the total earnings and current monthly tax - Employee has to leave after three months

the earnings are supposed to be 1,469,761.47

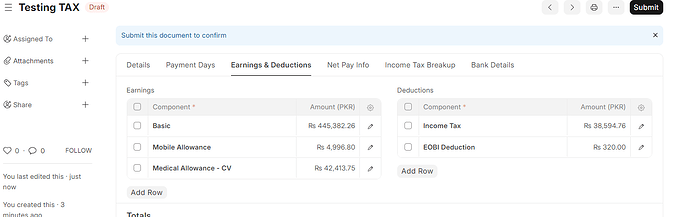

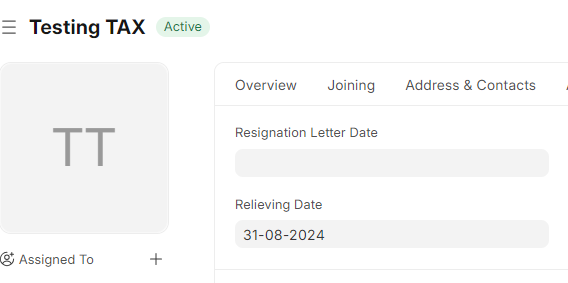

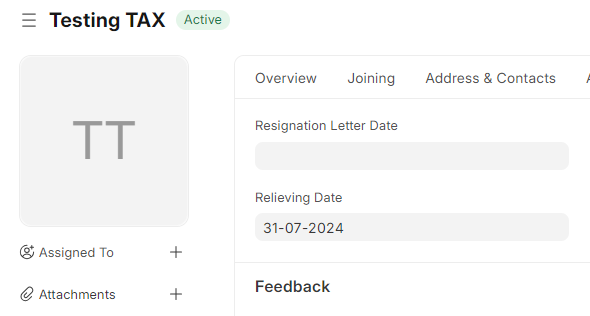

Now see this if I make changes in relieving date of same employee

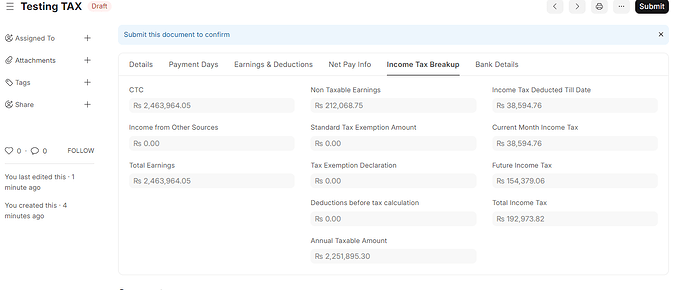

made no changes just removed eobi and saved it again and see what happens

look at the income tax again. its changed. also look at the breakup

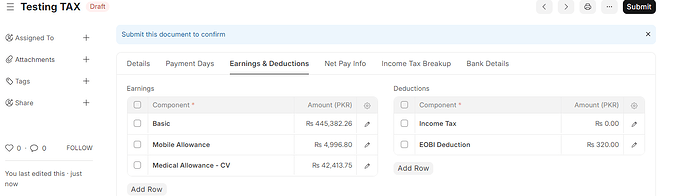

I will again change the relieving date to same month …

look at the tax now

its zero and look at the breakup

I am stuck with this loop ![]() can some one help me out how does this works

can some one help me out how does this works ![]()