Given the possibilities, I will share these scenarios, and how we are resolving them.

Scenario 1 - Payment to customer in full for total return

- Customer buys and receives a sales invoice.

2.Customer pays and leaves.

- A day later customer comes back to return full items

- Credit note is issued for invoice.

- Payment back to customer is registered against the party Customer

Scenario 1.a - Payment to customer in full for partial return

- Customer buys and receives a sales invoice.

- Customer pays and leaves.

- A day later customer comes back for a partial return of items

- Credit note is issued for invoice, for amount of items returned

- Payment to customer is registered against the party Customer, for partial amount returned

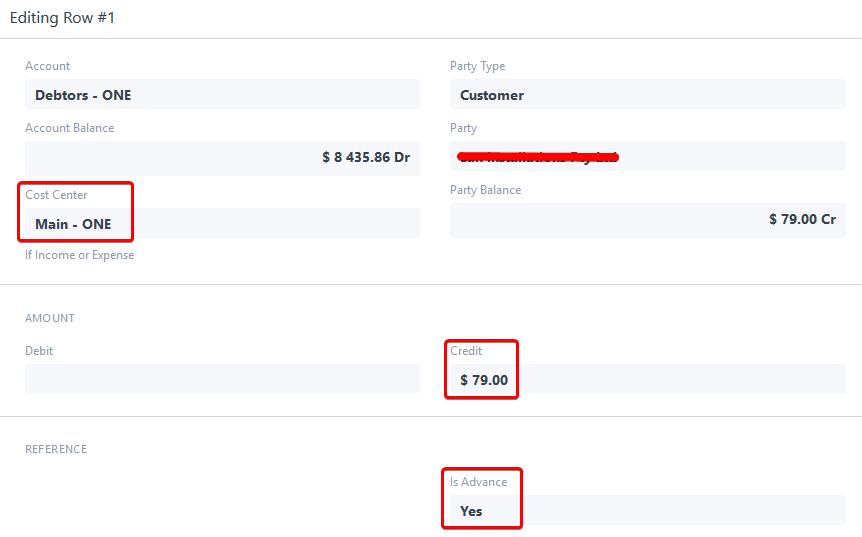

Scenario 1.b.full - Store credit for total return, credit used in full

- Customer buys and receives a sales invoice

- Customer pays and leaves

- A day later customer comes back to return full items

- Credit note is issued for invoice

- Customer is issued store credit only, thus no payment to customer is registered

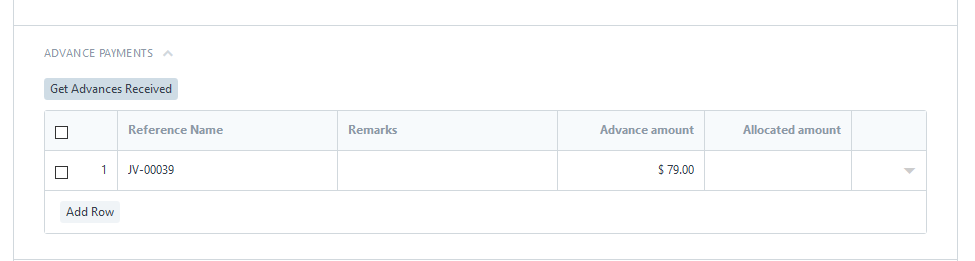

- Customer returns to use his credit

- New sales invoice is issued for full credit amount. No payment is required against new sales invoice.

- No credit remains

Scenario 1.b.partial - Store credit for total return, credit used partially

- Customer buys and receives a sales invoice

- Customer pays and leaves

- A day later customer comes back to return full items

- Credit note is issued for invoice.

- Customer is issued store credit only, thus no payment to customer is registered.

- Customer returns to use his credit, partially

- New sales invoice is issued for items, the amount being a partial portion of the available credit amount. No payment is required against new sales invoice

- Remaining Credit is pending use by customer.

Scenario 1.c.full - Store credit for partial return, credit used in full

- Customer buys and receives a sales invoice

- Customer pays and leaves

- A day later customer comes back for a partial return of items

- Credit note is issued for invoice, for return amount

- Customer is issued store credit only, thus no payment to customer is registered

- Customer returns to use his credit in full

- New sales invoice is issued for full credit amount. No payment is required against new sales invoice.

- No credit remains

Scenario 1.c.partial - Store credit for partial return, credit used partially

- Customer buys and receives a sales invoice

- Customer pays and leaves

- A day later customer comes back for a partial return of items

- Credit note is issued for invoice, for return amount

- Customer is issued store credit only, thus no payment to customer is registered

- Customer returns to use his credit, partially

- New sales invoice is issued for items, the amount being a partial portion of the available credit amount. No payment is required against new sales invoice

- Remaining Credit is pending use by customer.

The problem arises when Scenario 1.b.partial and scenario 1.c.partial occur.

At some point, you must cancel this debt in favor of your customer.

-

Customer can come to use his remaining credit after one instance of using store credit

-

Customer never returns

A scenario of the customer never returning can be dealt with in two ways, depending on your company policy:

A. Money is returned to your customer, for which you issue a payment for him in return.

B. A company policy dictates that credit in customer’s favor must be used by end of fiscal year

Thus we are left with scenario B, where customer never returned, repayment is not possible, and you must issue an invoice, in our case, legally required to be linked to a previously generated invoice, and thus we use Debit note to cancel the remaining credit without items sold or services rendered.

All scenarios before “B” can be dealt simply with Sales Invoice, Payment Entry and Credit Note or Sales Invoice Return.

Debit note is also used by us in scenarios where the Sales Invoice was issued with lesser amounts than what were supposed to be charged. Given that this invoice has been electronically signed in our case, it is legally inmutable, and thus a Debit note is issued, linked to the original invoice, for the items or amounts necessary to correct the error. This Debit note ensures accounting is precise.

For any valid invoice, we have added a Debit Note button, so that when pressed, the Sales Invoice is left as valid, and a new “Amended” Sales invoice is created, which changes the numbering series to the pre-configured Debit Note series. A link to the original Sales Invoice is kept, similar to when you use ERPNext’s Cancel>Amend>Save>Validate workflow. The Cancel button has been disabled, so that the only possible routes are to create a Credit Note or Debit Note

I will post the github code later.