How the reimbursement of tax amount on expense work in erpnext. I am bit confused with the following calculations in the screenshot.

If I increase the total claim amount, grand total will increase. So total claim amount has to be without tax.

Or if I am doing some mistake?

Hi,

That’s an interesting problem you bring up. I am not completely sure what the design behind including Taxes & Charges in the Expense Claim is. Can you run the accounting ledger for this transaction and post the results here?

If I have to guess, I am thinking that you would use the Taxes & Charges section in the Expense Claim if you are not booking a separate Purchase Invoice or an Accounting Entry (Journal Entry) for the underlying expense.

So, if you are going to book a Purchase Invoice or an Accounting Entry (Journal Entry), can you not make the Expense claim for the entire amount - Rs. 30,999.00?

If you have to use this approach, how about using a Tax Template where you say the base amount is inclusive of tax? Then maybe you can pay out the person claiming the expense the entire Rs. 30,999.00 and still book Taxes in the Expense Claim.

Hope this helps.

Thanks

Jay

Thanks Jay,

Actually I am not a core accounting guy, so would be afraid to answer.

I was just exploring option of claiming expenses for a purchase invoice raised to company for white goods (depreciating asset) but payment done by Director from personal credit card ( in absence of any other payment option).

So now there are two things:

- Whether my approach is right or wrong for mentioned scenario

- What’s the basis of design for expense taxes and charges as you also puzzled, as apparently the calculations are not setting right. Could be possible bug? @rmehta can suggest domain person who can bring light to this?

I am not too sure from a design perspective as to what the objective was for using the Tax Section in Employee Expense document, but for the use case scenario you have detailed (Director makes the payment), I think that your best bet is to make a Purchase Invoice or a Journal Entry separately for booking the expense related to the purchase and make the Expense Claim for the entire amount including GST and you pay out the entire amount.

The other option is for you to check what happens when you make the payment entry form the Expense Claim document Maybe there it will let you pay out the entire amount and maybe it will ask you for an expense account for the Base Value (Pre-Tax Value) of the purchase and maybe that will wrap up this thing very well. If it does, I’d still go and check if the GST Value is accounted in your GSTR statements.

Hope this helps.

Thanks

Jay

The same Problem I too faced.

I think, it’s after latest release update.

Hi

i created an account ’ VAT inclusive ‘in chart of account’

created a tax category ‘VAT inclusive’ and created ‘vat inclusive bills’ in purchase & charge Template.

The vat inclusive bills with check mark on ’ is tax included in Base price’.

All this set.

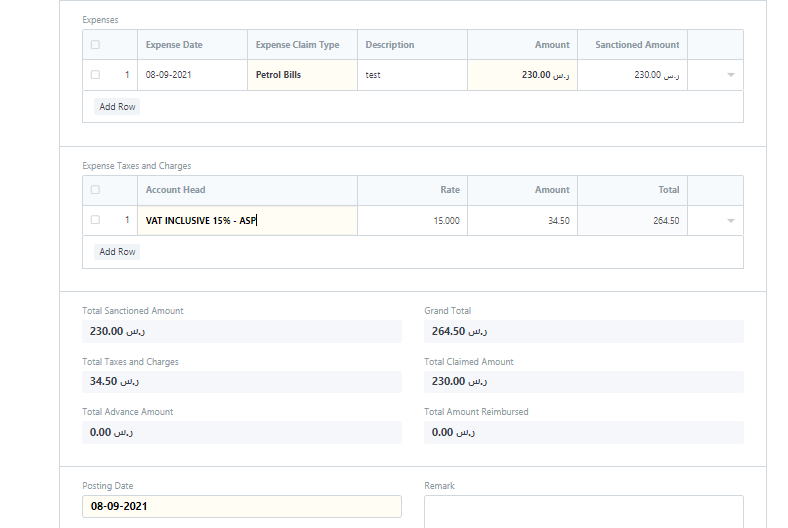

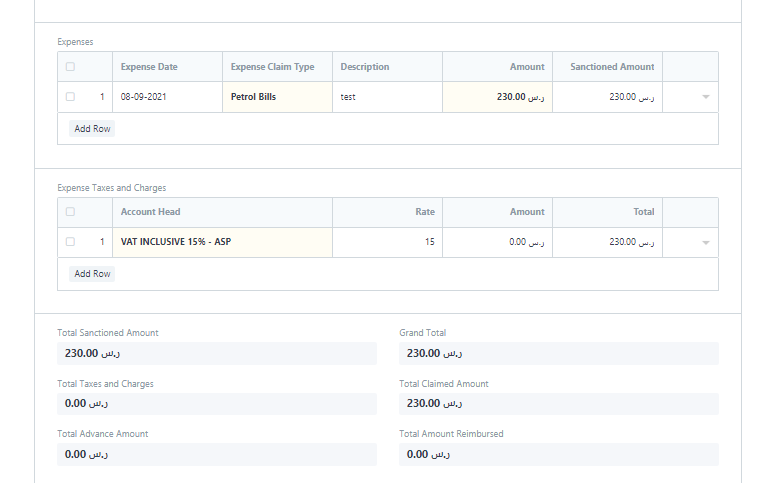

then i created an expense claim, as the image shows. it calculates correct.

but when done ,

The TAx amount disappears !?

Hi @rmehta

Can you please help in this subject i have posted above.

Below screenshot in Manual Doc.

i understand the case displayed here in manual is for employee met the expense bill of 1000 with addition of tax 270. So he should get claim amount of 1270 as tax is already paid. and chart of account tax is 270 and expense head is 1000.

Or

if the tax is inclusive of the expense amount, then the employee to get 1000 fully, and in the chart of account 131 for Tax and 869 to expense account.

The problem i face is , when expense claim is submitted, the tax amount disappears and the tax amount not reflect in the chart of account tax head.

Thanks & Regards

ismail