Hey,

It’s me again with a proposal for the changes I’m about to make to improve the Accounts module. The purpose of this proposal is so that people can identify whether their use-case can be handled with the proposed changes and for people to discuss them for further improvement in the proposed design.

Heavily inspired by: [Proposal] Item Tax Template · Issue #14187 · frappe/erpnext · GitHub

Key Features:

- Allow setting

Tax CategoryinSales/Purchase Taxes and Charges Template,Customer,SupplierandAddress - Automatic selection of

Tax Categoryin transactions based on either the (Billing?)Addressor the Party document - Automatic selection of

Sales/Purchase Taxes and Charges Templatebased onTax Categoryin transactions

- Allow setting Item-wise tax rates by setting

Item Tax Templatefor each item in transaction - Allow defining

Item Tax Templates inItems and replace the old Item Tax table - Also allow defining

Item Tax Templates inItem Groups - Automatic selection of

Item Tax Templatefor each item in transaction based onTax CategoryandItem’s/Item Group’s definedItem Tax Templates - Allow manually setting Item-row-wise tax rates in transactions by using a Tax Breakup table based on Frappe DataTable

Setting Item Tax Templates in Item:

- Note that you can set

Tax Categoryas empty so that it will act as the defaultItem Tax Template

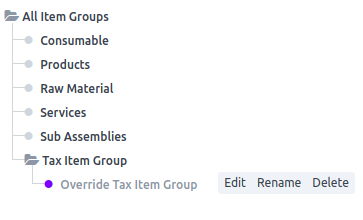

Setting Item Tax Templates in Item Group

- Note that children

Item Groupwill be able to overrideItem Tax Templatesto select for a certain Tax Category. AndItemwill be able to overrideItem Group’sItem Tax Template

Setting Tax Category in Sales/Purchase Taxes and Charges Template

- Tax Category is optional

- Each Tax Category can have a default Taxes and Charges template

Setting Tax Category in Address, Customer and Supplier

- There will be a field in all those DocTypes

- I think you can visualize it without a screenshot

How will transactions automatically determine Tax Category

- First it will check if the selected Address has a Tax Category assigned

- If not assigned if will check the party document (

CustomerorSupplier) for their Tax Category

How will transactions automatically pick Tax Templates

- If no

Tax Categorycan be determined in a transaction, it will pick theItem Tax Templates andSales/Purchase Taxes and Charges Templatewith emptyTax Category - If a

Tax Categoryis determined in a transaction, it will pick theItem Tax Templates andSales/Purchase Taxes and Charges Templatewith the sameTax Categorybut if not found it will look for ones with emptyTax Category - Only the

Sales/Purchase Taxes and Charges Templatechecked as default will be automatically picked in transactions!

How will conflict between Taxes and Charges Template and Item Tax Template be dealt with

-

Item Tax Templates will ONLY determine the (overriding) rate of the tax for the item - For a certain Tax to be applied in a transaction it MUST be included in

Taxes and Charges - I propose to include an additional field in the Taxes and Charges row:

Rate Type

-

- Default Rate: Use the tax rate set in Item row, if not found use the tax rate set in Taxes and Charges row

-

- Item Tax Rate: Use the tax rate set in Item row ONLY, if not found use 0 as rate

-

- Fixed Rate: Use the tax rate set in Taxes and Charges row ONLY

How to modify item rax rates and Item Tax Templates in transactions

- Use a DataTable to create a view of the breakup of tax and be able to modify the rates for the specific transaction

- Hide the old HTML table so that it can still be used for print formats

-

Item Tax Templates can also be set from the Item row

I hope this will be useful for ERPNext and you people. If it is, give me some support and some feedback.