Hello Community,

As a part of our initiative to improve upon existing functionalities, we are planning to introduce following breaking changes to India-specific features:

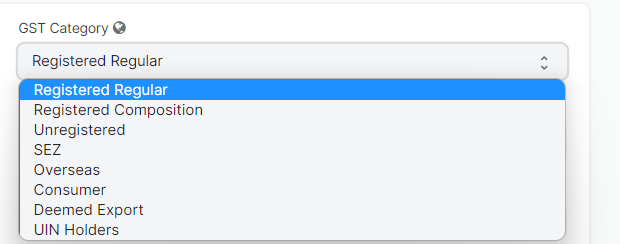

Deprecating Consumer GST category

Consumer as a separate GST category is not required and plays the same role as Unregistered. If you have existing Customers/Suppliers/Addresses with the Consumer category, they will appear as Unregistered after installing the India Compliance app.

Removing Eway Bill Report

This report was initially created with the objective to copy it to an Excel utility to generate e-Waybill JSON. ERPNext now offers the ability to generate JSON directly, so this report is no longer needed.

Side-note: we’re standardizing naming as well: e-Waybill and e-Invoice. Not Eway Bill or E WayBill or E Way Bill.

Dropping support for multiple GST accounts based on tax rate

For instance, different GST accounts like Output CGST - 2.5%, Output CGST - 9% won’t be supported anymore.

Earlier, at the time of Excise/VAT, there was legal requirement to maintain multiple accounts based on tax rate, so some users continued the same practice. We’re dropping support for this because:

- We plan to automate/simplify account selection for taxes and charges in sales and purchase transactions. Standardising this will improve consistency and will be easier to maintain.

- From HSN Summary or a similar report, anyone can get rate-wise breakup for analytical purposes.

- There is no legal requirement / added benefit.

If you’re using multiple accounts for different rates, migrating to a single account is really simple. You can do either of following:

- Merge different-rate accounts into a single account. For instance, you can merge Output CGST - 2.5% and Output CGST - 9% into a single account called Output CGST.

- Create new accounts from a new financial year and move existing account balances into these accounts.

Deprecating Update GSTIN functionality

When migrating from VAT to GST, it was useful to have a tool to request parties to update their GSTINs in your ERP. We don’t think this is useful anymore. If you still use this to request updates to your records, please let us know.

Removing defaults for C-Form and VAT

Custom fields for these features will no longer be created in a new installation.

Please let you know what you think about these changes and how they impact you. We’re open to requests to keep these features as-is and suggestions about what other changes you would like to see.