I have created purchase receipt for the invoice which has a total amount of 22500,

the ledger entry for that voucher is of amount 200158 which is being credited to the cost of goods sold account. how this amount is calculated ?

and sometimes the amount is credited from the cost of goods sold account for the purchase receipt.

Where you able to resolve this ?

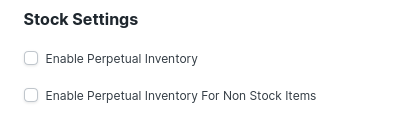

I found a workaround this by disabling “Perpetual Inventory” in company settings.

try redoing entries after you disable it.

While there are advantages to disabling perpetual inventory, you don’t quite need to do something as drastic.

There is a logic to why that value is getting posted to that account. You just need to patiently figure out why.

Since, these entries were being posted when you had perpetual inventory turned on, see if the following helps:

Go to your Company Master (Accounting>Company) Pick the Company and scroll down to the Stock Settings. Now check the choices in the Default Inventory Account and the Stock Received but not Billed Account. If either of those accounts are Cost of Goods Sold, change the Default Inventory Account to Stock in Hand and the Stock Received but not Billed Account to Stock Received but not Billed.

That should hopefully solve the “Which Account to hit” problem you have.

Now let’s turn to the value. You just need to look at the Purchase Receipt and see why the value is coming out wrong. See if it has anything to do with Stock UOM and the transaction UOM. Check if there is valuation of the item at play here. Or maybe you have different currencies.

99.9% of the cases, there is some transactional or configuration issue. ERPNext works great and very predictably almost all the time. This part especially is very reliable and predictable.

Hope this helps.

Thanks

Jay

Just in case if anyone ended up here again? this value is the difference between the Incoming Rate and the valuation rate… which seems to be okay to keep it

First you need to know what is the valuation rate and income rate?

For example if you have an Item, lets call it X with quantity of 5 pieces, its valuation rate is 0.2, so it would give you a total of 1. But, in this specific Purchase Receipt this item X, has an Incoming rate 0.3, which will give you a total of 1.5. This 0.5 is what being debited or credited from the COGS.